Difficult financial trading conditions across the board have contributed to a huge surge in clients for Streetbeat, an easy-to-use investing and trading platform with diversified investment strategies that help spread risk and reduce volatility shown in both stocks and cryptocurrencies. In June 2022, Streetbeat, an SEC registered investment adviser, saw a 120% increase in new clients, taking its total client base to over 90,000 just five months after launch. Streetbeat is designed to offer growth opportunities through a combination of professional, data-led strategies, auto trading algorithms, and access to hundreds of worldwide top stocks and leading cryptocurrencies strategies with Streetbeat Digital.

Damián Scavo, CEO of Streetbeat, said:

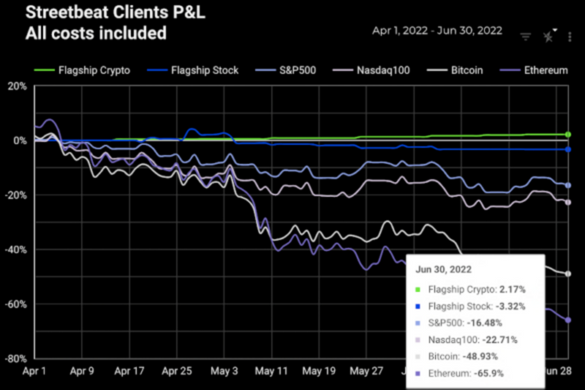

“The Streetbeat platform is designed to outperform the market through its usage of unique proprietary auto-trading strategies. This really stands out in bear markets like we’re in at the moment, with many of our clients able to maintain the value of their portfolios when other retail investors have reportedly suffered sharp losses. Our business model of providing a mixture of stocks, crypto, and defi all on one platform, means that clients can ride this period of instability much more successfully. On average, this quarter our clients have seen a growth of 2.2% in crypto strategies or losses of 3.3% in stock strategies, compared to an SP500 drop of 16.6%, Nasdaq drop of 22.7%, Bitcoin drop of 48%, and Ethereum drop of 63%.”

Streetbeat is available in 30 countries. Its massive new client growth has come from around the world. Streetbeat offers up to $10,000 in deposit bonus for new customers by downloading the Streetbeat app. Streetbeat also offers $3 to $3,000 dollars when you invite a friend to the platform.